Our Funds

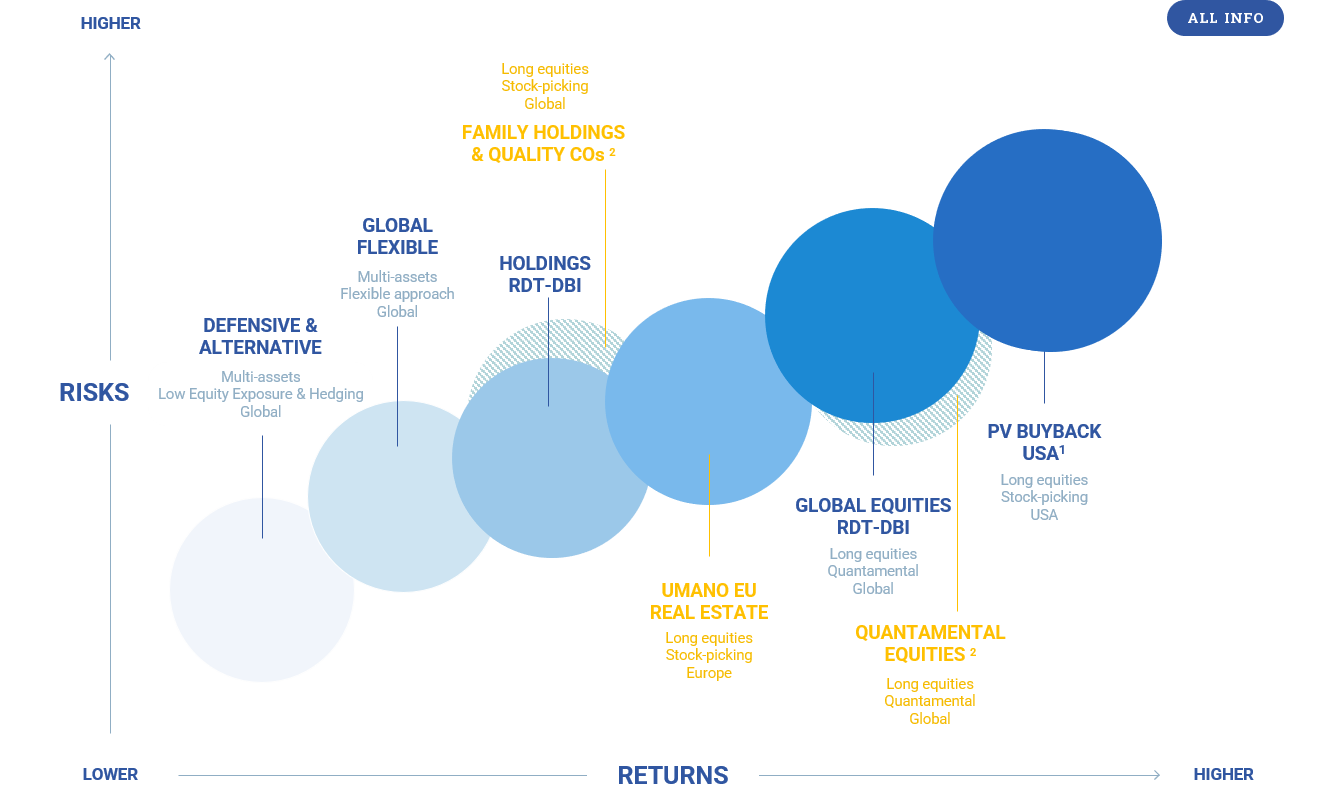

We offer internally managed funds adapted to your return objectives and your risk profile.

Our investment solutions tailored to your needs.

Our funds offering provides actively managed, multi-assets, quantitative and fundamental strategies covering the entire risk spectrum

Overview

Holdings RDT-DBI is an actively managed long-only equity fund. The fund primarily invests in Holdings companies and Quality stocks domiciled in the European Economic Area as well as OECD countries.

The universe of Holdings companies is limited but offers various advantages: substantial undervalued assets, diversification, indirect access to private equity investments and long term entrepreneurial and family strategic approach.

The fund’s investment strategy is based on Holdings Discount: a discount at which a Holding company generally trades (market value) compare to its assets fair value (intrinsic value).

The use of an internal proprietary model allows the Fund to properly identify this fundamental market dislocation and compare it to historical trends. Thorough financial analysis need to support an investment signal leading to a mean reversion of the discount.

This quantitative approach paired with thoroughly fundamental analysis enables to deliver recurring outperformances on a long investment horizon.

Holdings RDT-DBI is a sub-funds of Eurinvest UCITS, which allows Belgian companies to enjoy tax exemptions from RDT regime even without meeting the RDT requirements, unlike traditional corporate investments.

| Cumulative returns* | % |

|---|---|

| Year-to-date (28/06/24) | 5.7% |

| 2023 | 9.1% |

| 2022 | -12.9% |

| 2021 | 21.8% |

| 2020 | -7.8% |

| 2019 | 4.0% |

| Inception (annualized)* | 3.3% |

| Key Risk Indicators* | % |

|---|---|

| Volatility (annualized) | 10.6% |

| Sharpe ratio | 0.77 |

| Beta | 0.6 |

| Maximum drawdown | -11.2% |

* Calculations based on Holdings RDT-DBI I-share (€). Cumulative returns are net of fees. Key Risk Indicators are computed on a 2Y period. Past performance is not an indicator of future performance. Inception date is 29/03/2019.

Access Fund ressources

Latest Fund reports

All information on this Fund

Overview

Family Holding & Quality Cos is an actively managed long-only equity Fund. The Fund primarily invests in Holdings companies and Quality stocks domiciled in the European Economic Area as well as OECD countries.

The universe of Holdings companies is limited but offers various advantages: substantial undervalued assets, diversification, indirect access to private equity investments and long term entrepreneurial and family strategic approach.

The fund’s investment strategy is based on Holdings Discount: a discount at which a Holding company generally trades (market value) compare to its assets fair value (intrinsic value).

The use of an internal proprietary model allows the Fund to properly identify this fundamental market dislocation and compare it to historical trends. Thorough financial analysis need to support an investment signal leading to a mean reversion of the discount.

This quantitative approach paired with thoroughly fundamental analysis enables to deliver recurring outperformances on a long investment horizon.

Family Holding & Quality Cos is a sub-funds of Eurinvest LUXCITS.

| Cumulative returns* | % |

|---|---|

| Year-to-date (28/06/24) | 5.2% |

| Inception (annualized)* | 9.2% |

| Key Risk Indicators* | % |

|---|---|

| Volatility (annualized) | 9.2% |

| Sharpe ratio | 1.00 |

| Beta | 0.59 |

| Maximum drawdown | -10.0% |

* Calculations based on the Family Holdings and Quality Cos(€) I share. Cumulative returns are net of fees. Risk indicators are calculated over a 2-year period. Past performance is not indicative of future performance. The launch date is 10/03/2023.

Access Fund ressources

Latest Fund reports

Family Holdings and Quality Cos

Toutes les infos disponibles

Overview

Global Equities RDT-DBI is an actively managed long-only equity fund. The fund primarily invests in medium capitalization listed companies domiciled in developed countries.

The fund investment strategy is based on Factor Investing. Academic researchers have demonstrated that Factors risk premia are the main drivers of active management equity returns. Furthermore, each factor reacts differently to market and economic environments and holds different relationships with risk premia and market inefficiencies.

Therefore, by diversifying across five factors: [Quality, Dividend, Value, Growth and Low Volatilty], our Fund Managers are able to significantly reduce risks and better capture beta, resulting in better long-term performances.

To implement its strategy, the fund has adopted a “Quantamental” approach, a blend of quantitative and fundamental analysis. For years, our Fund Managers have developed a state-of-the-art proprietary model enabling to screen, rank and pre-select stocks by integrating sector and factor specifics. Then, their outstanding expertise in fundamental stock picking ensure to rigorously select the best stocks by performing in-depth and thorough analysis.

Global Equities RDT-DBI is a sub-funds of Eurinvest UCITS, which allows Belgian companies to enjoy tax exemptions from RDT regime even without meeting the RDT requirements, unlike traditional corporate investments.

| Cumulative returns* | % |

|---|---|

| Year-to-date (28/06/24) | 4.8% |

| 2022 | -10.5% |

| 2021 | 17.7% |

| 2020 | 4.1% |

| 2019 | 6.4% |

| Inception (annualized)* | 5.7% |

| Key Risk Indicators* | % |

|---|---|

| Volatility (annualized) | 11.2% |

| Sharpe ratio | 0.63 |

| Beta | 0.75 |

| Maximum drawdown | -13.4% |

* Calculations based on Global Equities RDT-DBI I-share (€). Cumulative returns are net of fees. Key Risk Indicators are computed on a 2Y period. Past performance is not an indicator of future performance. Inception date is 29/03/2019.

Access Fund ressources

Latest Fund reports

All information on this Fund

Overview

Family Holding & Quality Cos is an actively managed long-only equity Fund. The Fund primarily invests in Holdings companies and Quality stocks domiciled in the European Economic Area as well as OECD countries.

The universe of Holdings companies is limited but offers various advantages: substantial undervalued assets, diversification, indirect access to private equity investments and long term entrepreneurial and family strategic approach.

The fund’s investment strategy is based on Holdings Discount: a discount at which a Holding company generally trades (market value) compare to its assets fair value (intrinsic value).

The use of an internal proprietary model allows the Fund to properly identify this fundamental market dislocation and compare it to historical trends. Thorough financial analysis need to support an investment signal leading to a mean reversion of the discount.

This quantitative approach paired with thoroughly fundamental analysis enables to deliver recurring outperformances on a long investment horizon.

Family Holding & Quality Cos is a sub-funds of Eurinvest LUXCITS.

| Rendements cumulés* | % |

|---|---|

| Year-to-date (28/06/24) | -5.6% |

| Lancement (annualisé)* | -4.3% |

| Key Risk Indicators* | % |

|---|---|

| Volatility (annualized) | 10.9% |

| Sharpe ratio | (0.39) |

| Beta | 0.89 |

| Maximum drawdown | -15.3% |

* Calculations based on the Quantamental Equities I share (€). Cumulative returns are net of fees. Risk indicators are calculated over a 2-year period. Past performance is not an indicator of future performance. The launch date is 10/03/23

Documentation

Access Fund ressources

Latest Fund reports

Quantamental Equities

All information on this Fund

Overview

PV Buyback USA, sub-fund of DIM Funds SICAV, is a long-only equity fund focused on small and medium capitalization companies listed on the US equity market.

The fund investment strategy is grounded on the idea that share buybacks are signals for undervaluation. To identify those firms where the repurchase is most likely motivated by undervaluation, the Fund has developed a systematic approach analyzing 4 factors: fundamental valuation, size, momentum, motivation statement.

After a quantitative screening, the investment strategy becomes more qualitative and looks deeper into companies having a high score in the model, considering fundamental data, recent press releases and filings as well as insiders trading notifications.

The strategy is backed by 30 years of academic research from our fund Managers, Theo Vermaelen and Urs Peyers, both academics working at INSEAD with a strong track record in developing and implementing their investment strategy on Buybacks.

PV Buyback USA performances has been outstanding beating the Russell 2000, its benchmark, since its inception.

| Cumulative returns* | % |

|---|---|

| Year-to-date (28/06/24) | -1.9% |

| 2022 | -16.3% |

| 2021 | 25.9% |

| 2020 | 22.7% |

| 2019 | 19.5% |

| Inception (annualized)* | 10.5% |

| Key Risk Indicators* | % |

|---|---|

| Volatility (annualized) | 21.8% |

| Sharpe ratio | 0.38 |

| Beta | 0.95 |

| Maximum drawdown | -18.9% |

* Calculations based on PV Buyback USA B-share ($). Cumulative returns are net of fees. Key Risk Indicators are computed on a 2Y period. Past performance is not an indicator of future performance. Inception date is 30/06/2011.

Access Fund ressources

Latest Fund reports

All information on this Fund